Stock Picks.

- Likes Bear Creek Mining, very cheap, believes silver market will turn, Corani world class asset.

- Kirkland Lake Gold - turnaround stock, reserves. Price near 2 year high, room to move higher. (JGMS - Eric Sprott recently on board here)

- Doesn't like prospect generators, unlike many others. Sees sense of the model, the promotion is that they are safer. Charts and performance are mostly poor. Gambling stocks on exploration drillholes.

- Real interest rates driving gold. Expects 2015 bottom.

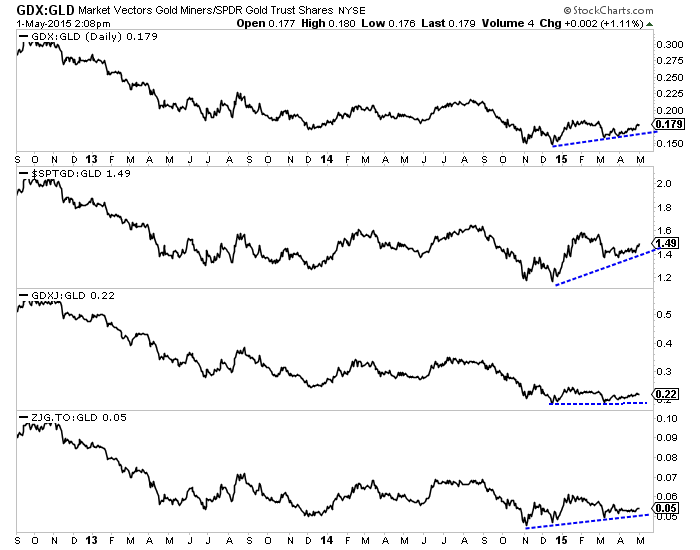

Recent article sees relative strength in the gold stocks even during gold's recent price decline as significant and evidence that gold miners may have bottomed relative to gold.

The reasons for the gold miners’ relative strength are unlikely to be temporary. Sure Oil has rebounded but its price remains well below the $100/barrel it averaged throughout 2011 to 2014. That is helping miners. In addition, local currency weakness has been a boon

No comments:

Post a Comment