As reported at IKN the traditionally large scale Cambridge House Vancouver Show looks to be poorly attended this year as junior metals exploration falls further out of favour and the companies involved run shorter of cash.

A more select "forum" has been put together with some well known letter writers.

Highlighted companies include - Eric Coffin's Liongold, Goldquest - John Kaiser on Sabina - Brien Lundin on Balmoral & Fission 3 - Gwen Preston's Kaminak & Pilot Gold. - Nevsun and First Mining Finance also announced attendance.

Post Show Review of 12 presenting companies

Eric Coffin in discussion with Gwen Preston

Seeking Junior Gold Miners and Silver Miners for Investment. Manage Your Hope & Fear. You really cannot just buy and hold - sell some to greed - buy into fear was never more true but hard to do.

Pages

- Home

- Site Map - Guide

- Good People In Good Projects

- Junior Gold with a Major Mining Shareholder

- Gold Merger and Acquisition Targets - Denver Gold Companies

- Emerging Multi-Project Consolidators - Growth - Mergers & Acquisitions plus

- Project Generators

- Emerging Gold Producers

- Old Gold Mines - New Exploration

- Regional Exploration

- Gold & Silver Discovery Stocks

- Large Low Grade Gold Deposits

- Silver Miners . . . . . .

- Junior Gold Stock Newsletter Picks

- Junior Gold Miners Stock Selection & Trading . . . . . . .

- Due Diligence - Gold Deposits, Production & $/oz

- Gold PEA / PFS / DFS / BFS Company Updates - NI 43-101 / JORC

- PDAC 2012 - Core Shack

- News - Stock Movers - Insiders - Broker Upgrades - Earnings - Warrants

- Why Gold ?

Sunday 31 May 2015

The Real Value of Gold in the Ground - Mickey Fulp / Cipher Research

Mercenary Geologist Mickey Fulp continues to publish an interesting series of deeper studies with Cipher Research.

Previously looking at the real long term costs and profitability of gold mining and "adequacy ratios".

The recent publication looks at the more junior "gold in the ground" explorers and developers, identifying points of over and under-valuation.

A case study of Rainy River, (with it's perfect bull ending at the start of 2011), subsequently bought out by New Gold makes clear the cycles of value creation and destruction for investors buying at different points in the discovery and development process and in particular during the bull and bear phases when capital floods in and out of the relatively small gold mining market. Valuations are leveraged to peak and increasing gold prices rather than more conservative and eventually pessimistic assumptions.

Whilst Fulp dismisses Rainy River as never being on his radar due to over-valuation it is clear that in bull markets for gold miners go-to stories emerge which can move well over "fair value". Value is far easier to find in bear markets but cheap can get cheaper until the turn.

Fulp leaves with some checklists to consider

Previously looking at the real long term costs and profitability of gold mining and "adequacy ratios".

The recent publication looks at the more junior "gold in the ground" explorers and developers, identifying points of over and under-valuation.

A case study of Rainy River, (with it's perfect bull ending at the start of 2011), subsequently bought out by New Gold makes clear the cycles of value creation and destruction for investors buying at different points in the discovery and development process and in particular during the bull and bear phases when capital floods in and out of the relatively small gold mining market. Valuations are leveraged to peak and increasing gold prices rather than more conservative and eventually pessimistic assumptions.

Whilst Fulp dismisses Rainy River as never being on his radar due to over-valuation it is clear that in bull markets for gold miners go-to stories emerge which can move well over "fair value". Value is far easier to find in bear markets but cheap can get cheaper until the turn.

Fulp leaves with some checklists to consider

- Because the consulting engineering firms operate in a highly competitive business environment, they are hired with the expectation of tailoring technical reports to the client’s needs and desires.....For this reason, investors must scrutinize engineering reports carefully. It is often necessary to make adjustments to the assumptions and key variables to arrive at a more realistic project value at any point in time........As an aside, have you ever come across a negative feasibility study? Remember folks, for every failed mine, there was a positive feasibility study

- Too often we find the so-called “experts” that lay investors choose to rely upon are not experts at all. Instead they are brokers, investment bankers, or in-house promoters whose primary interest is in collecting commissions or fees for selling stock, deals, and private placements, or earning consulting fees from the company....Folks, please make sure that you understand the motivations of any expert, analyst, broker, promoter, writer, or talking head whose advice you choose to follow. Here are a few questions you can ask that will afford valuable insight into this matter:

- Does he own shares in the company and at what price?

- Is he participating in the deal or placement with his own personal funds?

- Will he collect a commission or fees for selling you the stock or deal?

- Does he get paid to promote the company via fees, stock, and/or options?

- Is he or his firm underwriting the deal for a fee, commission, and/or warrants?

- Will he give you a full disclosure statement regarding his financial relationship with the company and/or project?

John Kaiser Interview

Interview At Korelin

Kaiser believes the better juniors have bottomed while sentiment is 1/10.

Discussion of Eastmain Resources as a destination for investors bought out of Probe by Goldcorp. Believes adding value through increasing understanding of the structural controls, spent too long in the past drilling and exploring, PEA due for current deposit plus future exploration potential.

Kaiser "Tracker" report on Eastmain (much of Kaiser's work can be followed free after a short period)

Deposit comparables from Eastmain's presentation

Kaiser believes the better juniors have bottomed while sentiment is 1/10.

Discussion of Eastmain Resources as a destination for investors bought out of Probe by Goldcorp. Believes adding value through increasing understanding of the structural controls, spent too long in the past drilling and exploring, PEA due for current deposit plus future exploration potential.

Kaiser "Tracker" report on Eastmain (much of Kaiser's work can be followed free after a short period)

Deposit comparables from Eastmain's presentation

Sunday 17 May 2015

Peter Brandt - Turns Bullish on Silver

Peter Brandt called the bear in 2011 and is now bullishly inclined

I am moving into a state of high alert in Silver. While I still am inclined to trade a breakout in either direction (given a measured-risk entry), my preference is now slanted toward the buy side. Silver could become rather exciting during the weeks ahead.

Eric Coffin Gold Stock Picks

A number of Coffin's recent write ups have seen significant moves. Interview at The Gold Report with picks.

Sunday 10 May 2015

6 Juniors that have soared in 2015

Smallcap-Power

Canadian high grade / turnaround - Claude, Eastmain, Kirkland Lake

Nevada high grade - Klondex

Senegal backed by Franco Nevada - Teranga

Toll Processor - Dynacor

Canadian high grade / turnaround - Claude, Eastmain, Kirkland Lake

Nevada high grade - Klondex

Senegal backed by Franco Nevada - Teranga

Toll Processor - Dynacor

Saturday 9 May 2015

Wednesday 6 May 2015

Calling Bond Bear Markets

Quite a few big names pointing to a potential bottom in interest rates and peak in bonds.

Calafia Beach pundit commentary and analysis.

Gary Tanashian points out that the bond bull "continuum" is still very much in place

Calafia Beach pundit commentary and analysis.

What prompted me to make this call? It was the recent 47 bps bounce in 10-year German bund yields, off of an incredible low of 0.05% a few weeks ago.Whereas Armstrong suggests a final blow off top in bonds, as stock markets dip, and divergent strength in the US against European before the true rush from government debt & bonds floods into the US stock market.

Gary Tanashian points out that the bond bull "continuum" is still very much in place

UK Election - Austerity

Looking like a very tight result and another coalition to come.

Acting-Man discusses the reality of the UK economy.

Sunday 3 May 2015

Martin Armstrong on the end of cash - negative interest rates - bond bubbles and Gold

Armstrong's recent focus on controls of cash holdings, negative interest rates and debt/bond bubbles coming into the September 2015 period. Some would see a role for gold, Armstrong suggests not yet.....more.....

Jordan Roy Byrne - Relative Strength in the Miners - Plus Stock Picks

Interview at Kitco

Stock Picks.

Stock Picks.

- Likes Bear Creek Mining, very cheap, believes silver market will turn, Corani world class asset.

- Kirkland Lake Gold - turnaround stock, reserves. Price near 2 year high, room to move higher. (JGMS - Eric Sprott recently on board here)

- Doesn't like prospect generators, unlike many others. Sees sense of the model, the promotion is that they are safer. Charts and performance are mostly poor. Gambling stocks on exploration drillholes.

- Real interest rates driving gold. Expects 2015 bottom.

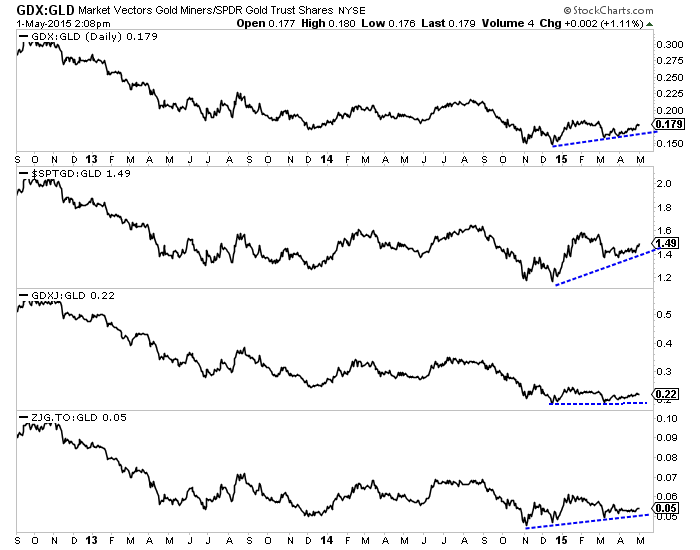

Recent article sees relative strength in the gold stocks even during gold's recent price decline as significant and evidence that gold miners may have bottomed relative to gold.

The reasons for the gold miners’ relative strength are unlikely to be temporary. Sure Oil has rebounded but its price remains well below the $100/barrel it averaged throughout 2011 to 2014. That is helping miners. In addition, local currency weakness has been a boon

Jim Rogers - Waiting for US Dollar Bubble Top to Buy More Gold

Interview with Jim Rogers. Still likes stocks in China, Russia, Japan.

Waiting for US$ bubble top to buy more gold, maybe....(on gold from start of interview)

Sees US rate hike, market dip, easing, blow off top.

Waiting for US$ bubble top to buy more gold, maybe....(on gold from start of interview)

Sees US rate hike, market dip, easing, blow off top.

Saturday 2 May 2015

Why the Rush into Canadian Gold Mines May Continue - Sprott's Todoruk

The weak Canadian dollar is making Canada's relatively safe jurisdiction more appealing for acquisitions. The same argument might be put for Australian deposits yet the majors have made a number of divestments, is their need to strengthen balance sheets forcing sales?

Todoruk's short list of appealing Canadians includes

Todoruk's short list of appealing Canadians includes

a short list of well-followed companies would include Detour Gold for its Detour Lake mine, Pretivm Resources for its large, high-grade Valley of the Kings deposit, Rubicon Minerals for its very near-production Phoenix gold mine, Richmont Mines with its Island Gold mine, Lakeshore Gold with its producing gold mines in the Timmins mining camp, Kirkland Lake with its producing mine in eastern Canada, and Kaminak Gold which owns the Coffee gold deposit in the Yukon.

Friday 1 May 2015

Subscribe to:

Posts (Atom)