Another Sprott Interview - Transcript

Seeking Junior Gold Miners and Silver Miners for Investment. Manage Your Hope & Fear. You really cannot just buy and hold - sell some to greed - buy into fear was never more true but hard to do.

Pages

- Home

- Site Map - Guide

- Good People In Good Projects

- Junior Gold with a Major Mining Shareholder

- Gold Merger and Acquisition Targets - Denver Gold Companies

- Emerging Multi-Project Consolidators - Growth - Mergers & Acquisitions plus

- Project Generators

- Emerging Gold Producers

- Old Gold Mines - New Exploration

- Regional Exploration

- Gold & Silver Discovery Stocks

- Large Low Grade Gold Deposits

- Silver Miners . . . . . .

- Junior Gold Stock Newsletter Picks

- Junior Gold Miners Stock Selection & Trading . . . . . . .

- Due Diligence - Gold Deposits, Production & $/oz

- Gold PEA / PFS / DFS / BFS Company Updates - NI 43-101 / JORC

- PDAC 2012 - Core Shack

- News - Stock Movers - Insiders - Broker Upgrades - Earnings - Warrants

- Why Gold ?

Tuesday 28 April 2015

Sunday 26 April 2015

Junior Gold M&A - Novacopper buy Sunward.

Some big names, Thomas Kaplan's Electrum, John Paulson, and Seth Klarman's Baupost have been significant holders of Sunward, trading below their high $20m cash (no debt).

Sunward hold a very large scale (global top 3%) low grade (0.53g au) Gold-copper deposit, Titiribi, in Colombia which has yet to see an economic study, but would presumably be a project requiring a much higher real gold price and then be highly leveraged to the 10m oz + gold (mostly inferred) & 800m lb copper.

NovaCopper have many of the same holders. The acquistion appears to look to apply Sunward's cash to advance NovaCopper's Alaskan copper deposits.

Sunward hold a very large scale (global top 3%) low grade (0.53g au) Gold-copper deposit, Titiribi, in Colombia which has yet to see an economic study, but would presumably be a project requiring a much higher real gold price and then be highly leveraged to the 10m oz + gold (mostly inferred) & 800m lb copper.

NovaCopper have many of the same holders. The acquistion appears to look to apply Sunward's cash to advance NovaCopper's Alaskan copper deposits.

Eric Coffin can still draw the crowds

The junior market can still come alive to a good promo by a respected letter writer. The 5 year chart puts the 40%+ increase in perspective. This one went out to Coffin's email list and also via CEOca which appears to be getting in with Brent Cook, Coffin, Roulston and Sprott.

Perhaps it helped that juniors with deposits have been seeing M&A bids.

Perhaps it helped that juniors with deposits have been seeing M&A bids.

Thursday 23 April 2015

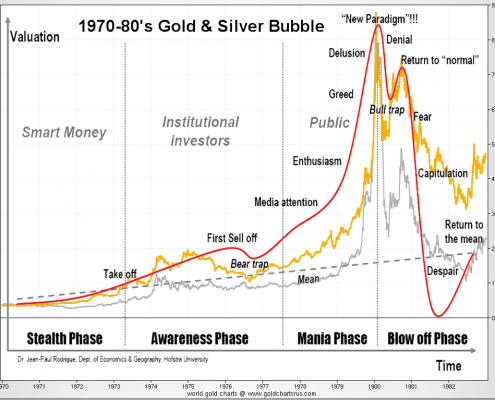

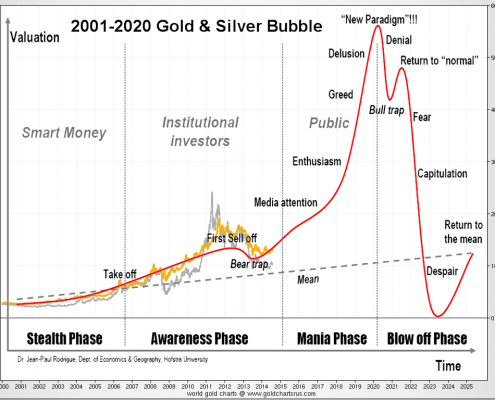

Gold Bubbles

Chris Vermeulen has cooled on gold for the past few years but is suggesting the bull resumes later this year. Clearly if both the charts below spanned the same period, the 2011 peak was it.

Taking Steve Saville's analysis of the "1970s" gold bull however he would show the real move in the miners starting in the 1960s even while the metal price was fixed.

Taking Steve Saville's analysis of the "1970s" gold bull however he would show the real move in the miners starting in the 1960s even while the metal price was fixed.

Wednesday 22 April 2015

Drill Baby Drill

You thought 2ft concrete walls would protect your valuables?

Details of Easter Robbery of safety deposit boxes in Hatton Garden, London

Details of Easter Robbery of safety deposit boxes in Hatton Garden, London

Tuesday 21 April 2015

Aussie Gold Mines for Sale - Newcrest's Telfer and Barrick's Cowal

More Aussie Gold assets look to be hitting the market with Newcrest named as both potential buyer and seller.

- Newcrest and Hecla amongst bidders for Barrick's Cowal, 1.5m oz P&P, 270k oz production @ $740-$775 AISC

- Bank of America Merrill Lynch seeking bids for Newcrest's Telfer mine, >500k oz gold production 2014

Monday 20 April 2015

Gold Miner M&A - Evolution Mining bid for La Mancha Australia Assets

Evolution will grow to 530-600k oz pa -

La Mancha will own ~30% and provide $100m cash for more growth.

Presentation

La Mancha will own ~30% and provide $100m cash for more growth.

Presentation

Saturday 18 April 2015

Sprott launch Junior Gold Mining ETF - SGDJ

Sprott have followed the launch if their Gold Miners ETF - SGDM with a Junior Gold Miners version - SGDJ.

There are a couple of conflicting messages

What are the SGDJ holdings? Are they different from GDXJ Holdings or BMO's ZJG Holdings?

Sprott have less royalty here, B2 and Centerra are much more significant and the x3 silver miners stand out, though I recall GDXJ started out with a high % of silver miners.

So how has Sprott's senior Gold Miner ETF - SGDM fared since launch against GDX Holdings?

Not so good.

Here they have a policy of high exposure to "stronger balance sheets" in particular Randgold and Franco Nevada, which did not suffer to the degree Barrick, Goldcorp and Newmont did and have not seen the same rebounds.

There are a couple of conflicting messages

Very junior discovery activity seems out of bounds (similarly even "GLDX explorers ETF holdings" are mainly developers of well explored and defined deposits, so really just taking the producing aspect out of GDXJ).

- "Why invest in junior miners? -"High-value discoveries and mine development can create enormous upside potential" ..........But......."The Index methodology tends to favor junior and intermediate producers versus early stage exploration companies whose historical success rate is low."

What are the SGDJ holdings? Are they different from GDXJ Holdings or BMO's ZJG Holdings?

Sprott have less royalty here, B2 and Centerra are much more significant and the x3 silver miners stand out, though I recall GDXJ started out with a high % of silver miners.

| COMPANY | TICKER | Weight % |

| B2Gold Corp | BTO CN | 7.71% |

| Centerra Gold Inc | CG CN | 6.46% |

| First Majestic Silver Corp | AG US | 6.08% |

| Hecla Mining Co | HL US | 5.63% |

| Pan American Silver Corp | PAAS US | 5.60% |

| Alamos Gold Inc | AGI CN | 5.23% |

| Harmony Gold Mng-Spon ADR | HMY US | 4.23% |

| IAMGOLD Corp | IAG US | 4.16% |

| Primero Mining Corp | PPP US | 3.72% |

| OceanaGold Corp | OGC CN | 3.47% |

| Sandstorm Gold Ltd | SAND US | 3.41% |

| Aurico Gold Inc | AUQ US | 3.17% |

| Detour Gold Corp | DGC CN | 3.00% |

| Rio Alto Mining Ltd | RIO CN | 2.74% |

| China Gold International Res | CGG CN | 2.69% |

| Nevsun Resources Ltd | NSU CN | 2.65% |

| Alacer Gold Corp | ASR CN | 2.59% |

| Kirkland Lake Gold Inc | KGI CN | 2.57% |

| Lake Shore Gold Corp | LSG CN | 2.47% |

| Novagold Resources Inc | NG US | 2.26% |

| Argonaut Gold Inc | AR CN | 2.22% |

| Semafo Inc | SMF CN | 2.05% |

| Fortuna Silver Mines Inc | FSM US | 1.87% |

| Silver Standard Resources | SSRI US | 1.67% |

| Endeavour Silver Corp | EXK US | 1.55% |

| Dundee Precious Metals Inc | DPM CN | 1.47% |

| Torex Gold Resources Inc | TXG CN | 1.46% |

| Gold Resource Corp | GORO US | 1.37% |

| Pretium Resources Inc | PVG US | 1.22% |

| Rubicon Minerals Corp | RBY US | 1.04% |

| Premier Gold Mines Ltd | PG CN | 0.97% |

| Mag Silver Corp | MAG CN | 0.78% |

| Seabridge Gold Inc | SA US | 0.71% |

| Guyana Goldfields Inc | GUY CN | 0.66% |

| Asanko Gold Inc | AKG CN | 0.59% |

| Continental Gold Ltd | CNL CN | 0.53% |

So how has Sprott's senior Gold Miner ETF - SGDM fared since launch against GDX Holdings?

Not so good.

Here they have a policy of high exposure to "stronger balance sheets" in particular Randgold and Franco Nevada, which did not suffer to the degree Barrick, Goldcorp and Newmont did and have not seen the same rebounds.

Canada's Discovery Performance - Richard Schodde - MinEx Consulting

Another interesting presentation from Richard Schodde at MinEx (many more presntations here including Pacific region)

Covering the volatility of exploration spending, the importance of juniors in discoveries and the rarity and importance to valuation of tier 1 and 2 discoveries.

Covering the volatility of exploration spending, the importance of juniors in discoveries and the rarity and importance to valuation of tier 1 and 2 discoveries.

$1Bn Quebec Mining Fund

Reported at Pierce Points and Bloomberg

While Finance Minister Carlos Leitao announced plans for the fund in June, Quebec’s legislature has yet to authorize its creation. Capital Mines Hydrocarbures should be able to support as many as 10 mining projects once it begins operating, Daoust said. “The raison d’etre of that fund is to make sure that at the end of the day, if the funding is complicated for the last 10 or 20 percent of a project, we will be there,” the minister said. “We can go to C$200 million, but normally we should not invest more than 10 or 15 percent of a project.”

Friday 17 April 2015

Wednesday 15 April 2015

Adrian Day Interview with Sprott's Tekoa Da Silva

Another recent interview from Sprott, this time with Adrian Day, a long standing investor in the natural resources space. Transcript and youtube at the link.

Gold M&A - Alamos - Aurico Gold $1.5bn merger

Two equally sized mid-tier gold miners, Alamos and Aurico, are set to merge.

John McCluskey of Alamos would be CEO of the combined company with operations in Ontario and Mexico and development in Turkey. Rival bids seem likely. TD suggest the deal is dilutive for Alamos.

Alamos stock held up very well during the earlier part of the bear market but has since slipped.

Aurico struggled as Gammon gold, disposed of key Mexican assets to Carlos Slim companies and focused on the new, and potentially very large, Young Davidson mine in Canada which was a buyout of Northgate minerals for $1.46bn in 2011.

John McCluskey of Alamos would be CEO of the combined company with operations in Ontario and Mexico and development in Turkey. Rival bids seem likely. TD suggest the deal is dilutive for Alamos.

Alamos stock held up very well during the earlier part of the bear market but has since slipped.

Aurico struggled as Gammon gold, disposed of key Mexican assets to Carlos Slim companies and focused on the new, and potentially very large, Young Davidson mine in Canada which was a buyout of Northgate minerals for $1.46bn in 2011.

Barron's - Newmont shares could rise 55%

Mainstream Barron's on Newmont

But Newmont, the world’s No. 2 gold producer after Barrick, is likely to emerge a winner even if gold falls further. The Greenwood Village, Colo.–based company has sold assets and cut costs, reducing its break-even production price by about $200 in the past two years, to $1,002 an ounce.

Ross Beaty Interview with Sprott's Tekoa Da Silva

Transcript - HERE

Ross Beaty has been making significant junior investments recently - see HERE

Ross Beaty has been making significant junior investments recently - see HERE

Put all that together and it’s all happening now. You know what? There are a lot of weird things that I can’t really figure how it’s going to end. But quite frankly, my salvation here, my refuge, is in precious metals. It’s in gold and silver. So I’m very bullish on gold right now. I’m particularly bullish watching what’s happening to the gold price relative to the US dollar. I’m bullish on silver because silver will follow gold. Silver has always traded with gold...........This is the end of four years of really weak markets, in the metal space and in the resources space. So a lot of investors are bruised and bloodied. We’re starting the fifth year. If the tide is going out and there is a huge macro wave -- a wave for metal prices declining, you’re probably better off to own the metal than the companies, because the companies tend to underperform the metals in a bear market. Bear markets feed on themselves. So if an investor is losing money, he’s not going to want to buy another speculative gold company or copper company. So it’s true that even in bad, bad markets, you will have some great investment successes where a company has had good exploration results or has done a really, really smart acquisition. You will have those. But typically the whole sector is going to be losing out and the best strategy then is to do what nobody does which is sell at the top. Buy at the bottom, sell at the top. That’s what you’re supposed to do. But of course nobody ever does that. It’s times like this where we’ve had four years of bear markets and I don’t know whether the bear is going to turn into a bull market in a year or two years or two days. I really don’t know when the bottom is. But I know this is not the top. We’ve had four years of terrible markets. I would say today is just a really good time to be building a portfolio of well-run junior companies. My bias is in gold because I think that gold and silver are going to outperform the other metals. But buy a portfolio of companies and really focus on a couple of things. One is the asset has to be good. You can have a genius with a crappy asset and he’s not going to make money. You can have an idiot with a phenomenal world class asset and he’s actually going to make money. The stock is going to go up. The second thing is: people are really, really important. But my first priority is to look at the asset, to look at the quality of the project that the company has............there are a lot of similarities today to what typically happens in the bottom of the bear market. There is a lot of sadness, a lot of difficulty raising money, a lot of very stressed junior companies, and very unhappy investors. That’s the nature of the beast. When things turn, the tide will come in and everybody will be happy again.

Brent Cook Interview with Sprott's Tekoa Da Silva

Interview from a couple of weeks ago - HERE with Transcript

The major mining companies are decreasing their costs, but what they’re really doing is increasing their future costs. They’re pushing costs out into the future. That has to be resolved but my sense is that we are in a bottoming process. I don’t think it’s going to get a lot worse and I think that two or three years out, these major mining companies are going to wake up to the fact that they’ve shut down exploration. They’ve shut down their development. They’ve got nothing in the pipeline and all of a sudden when they’re announcing their costs the analysts will start saying, “Yeah, but you don’t have any more ore.”So you want to identify the properties and the people that can last through this bottoming period, as well as those companies that will come out the other end in possession of the very few quality discoveries that are out there. That’s all you’ve got to do—simple, right? Haha......There are probably six gold projects in the world right now that are being developed that I think will probably work, held by junior companies. I’m not talking about majors.In terms of companies that are competent, we’ve got something like 1500 listed on the Vancouver exchange. I would say probably – 20% percent of them are companies that I would consider putting money into [in the right circumstance]......Maybe 25%. But I don’t buy everything. My portfolio, I try and keep it to 20 companies or less and I think that’s something investors should do as well. If you own too many stocks, you forget why you bought them. They go up, they go down…and then you start hoping they go back up for no reason at all. That’s my philosophy anyway.

Sunday 12 April 2015

Why is Gold Mining such a Crappy Business - Saville

Steve Saville has a follow up article to an earlier one discussing why Gold Mining has seen such poor returns.

Both owe a great deal to Doug Pollitt's Denver Gold 2014 presentation which deserves a full read.

There are suggestions that some companies are becoming better allocators of capital.

It also supports Brent Cook's repeated thesis that a more rational industry will be even hungrier for quality junior projects and discoveries when the market does turn.

Both owe a great deal to Doug Pollitt's Denver Gold 2014 presentation which deserves a full read.

It is really quite amazing that we chucked billions and billions and got no supply response at all. What this tells us is that there is simply not a lot of gold out there. How many genuine finds were there in the last cycle? Half a dozen? A dozen? In fifteen years we might have discovered enough new material to keep the mills turning for two or three years. The raw material was just not there, even in the face of the avalanche of money to tease it out.......... To step back and re-cap: being an asset class unto itself which from time to time comes into favour generates substantial investment demand. Gold is a small sector to begin with – lots of money into a small sector drives down the cost of capital and encourages issuance. Against this there are fewer still opportunities within the small sector to invest the incoming capitalThis leads to gross misallocation of capital as the financial sector chases scale, growth and leveraged returns in marginal projects. As Saville discusses elsewhere buying low value ounces in the ground was once a successful strategy, but not now. As Rick Rule has discussed this leaves a marginal industry as prices fall.

There are suggestions that some companies are becoming better allocators of capital.

It also supports Brent Cook's repeated thesis that a more rational industry will be even hungrier for quality junior projects and discoveries when the market does turn.

Larry Edelson remains Bearish on Gold and Miners

After calling for a resumption of the bull last June (with the launch of an expensive advisory service - any refunds?) Edelson quickly reverted to a bearish position and now sees a big sell off coming 14th April and likely long term lows in May, June or October - so a few options there.

Edelson suggests he is close to Martin Armstrong who sees major "big bang" in bond markets in September 2015. Will gold be a refuge or initially sell off too? As miners topped at the end of 2010 well ahead of peak gold prices some better issues may see strength ahead of gold lows, some significant investors are putting capital to work, Beaty, Lundin and others.

But perhaps many more, Rick Rule for example, are looking for a final vicious capitulation bottom.

Edelson suggests he is close to Martin Armstrong who sees major "big bang" in bond markets in September 2015. Will gold be a refuge or initially sell off too? As miners topped at the end of 2010 well ahead of peak gold prices some better issues may see strength ahead of gold lows, some significant investors are putting capital to work, Beaty, Lundin and others.

But perhaps many more, Rick Rule for example, are looking for a final vicious capitulation bottom.

Whitman Howard - Roger Bade - Mining stocks April-2014

Roger Bade was early calling the mining bear market. An out-dated report from April-14 reviews some UK listed miners. (click on link at bottom of page)

Comparisons with 1970s Gold Bull - Saville

Steve Saville highlights problems in comparing the recent gold bull against the 1970s where gold prices started out fixed. The mining stocks reflected the early 60's start of the bull.

Dollar movements before and after Fed interest rate increases

Market Anthropology shows past movements in the dollar index after interest rate rises. Of course they haven't risen yet.

Thursday 9 April 2015

Biggest Indian Jewellery Maker Looks to Spend $700m on Aussie Goldminers

A story reported by Dave Pierce, initially published at the Australian Financial Review.

Rajesh Metha of Rajesh Exports is India's largest jewellery manufacturer with a $1.2bn market cap in Bombay, vertically integrated through mining, refining, manufacturing and retailing.

The company consumes 140T of gold pa, around 15% of Indian imports, and has apparently decided gold miners are cheap enough, now looking to spend $700m in Australia where annual gold production is around 280T pa. The timing seems a little odd following a number of disposals by the majors whereby Northern Star has emerged as a significant force.

Linked are some of Australia's biggest gold miners

Rajesh Metha of Rajesh Exports is India's largest jewellery manufacturer with a $1.2bn market cap in Bombay, vertically integrated through mining, refining, manufacturing and retailing.

The company consumes 140T of gold pa, around 15% of Indian imports, and has apparently decided gold miners are cheap enough, now looking to spend $700m in Australia where annual gold production is around 280T pa. The timing seems a little odd following a number of disposals by the majors whereby Northern Star has emerged as a significant force.

Linked are some of Australia's biggest gold miners

Mr Mehta would not name the Australian mines nor companies that he was looking at, but said talks with advisers had begun. "We have met a lot of investment bankers here and we are evaluating the best way to get in, what is the best way to do it, as we are looking at not only taking interest in the gold mining sector but we are also looking at forging a relationship with the largest gold-producing mines to buy and ensure supply from them," he said. "We can be a good consuming partner for them." The comments follow recent momentum towards a free trade agreement between Australia and India, and last year's visit to Australia by Indian Prime Minister Narendra Modi. It also comes after two years of regular deal-making in the Australian gold industry, as several foreign gold miners have sold assets to try to reduce their exposure to Australia.

Junior Speculation - $20k to $15m to $4m

CEOca put up this discussion with Robert Hirschberg, a venture stock speculator who has made it and lost it over several decades. Hope & warning in equal measure.

Monday 6 April 2015

Mining Costs and Innovation

Bearish metals markets should drive cost reduction and innovation.

Mish reports on Caterpillar's innovations with autonomous trucks.

An older report highlights potential energy innovation utilising solar power in remote mine sites like Sandfire's DeGrussa mine. The cost savings are perhaps less clear with low oil prices.

Mish reports on Caterpillar's innovations with autonomous trucks.

An older report highlights potential energy innovation utilising solar power in remote mine sites like Sandfire's DeGrussa mine. The cost savings are perhaps less clear with low oil prices.

Sunday 5 April 2015

OT - Troubled Morrissey

TroubledMozza has some wonderful tweets to amuse those who find Smiths lyrics popping into their minds from time to time. Some classics were linked at The Poke which I have linked below a little music to accompany, but a full browse of Troubled Morrissey's Twitter is essential for the Smiths inclined.

Subscribe to:

Posts (Atom)