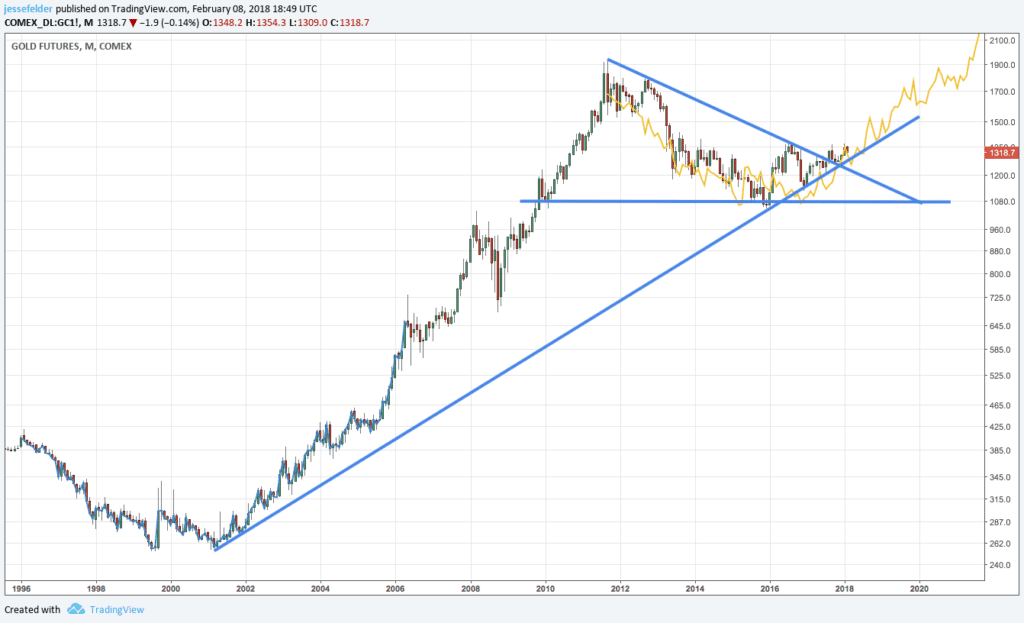

I have seen little public commentary on the Basel III changes, but this seems to set the stage for serious flows into Physical Gold by financial institutions.

....under Basel III, monetary gold now qualifies as a Tier 1 asset, and is 100% valued for the purposes of banking viability. Another point to consider is that SIFIs are now required to quadruple their reserves when compared to the previous minimum requirements before the banking crisis. Essentially, monetary gold is now considered risk free. This significant development remains relatively unknown – for now......The Basel Committee on Banking Standards (BCBS) scrapped the old Basel II framework and put in place a plan that will be fully realized by all SIFIs by 2019.......February 2018 marked a major turning point for gold – monetary gold to be more specific – when the Swiss National Pension Fund switched out of synthetic gold derivatives into physical gold. Monetary gold is defined, in the new Basel III banking capital rules, as “physical gold held in their own vaults or in trust.” The Swiss decision complied with the new banking standards regarding capital adequacy as it relates to solvency and viability. All Systemically Important Financial Institutions (SIFI) must comply with the new rules for Net Stable Funding Ratio (NSF) and Liquidity by January 2019. Lessons learned from the last liquidity crisis, when Lehman Brothers nearly caused a global financial meltdown, forced a rethink in how assets held on an institution’s balance sheet are to be valued. Counter-party risk became extremely important again. In short, when trust between SIFIs fails, liquidity dries up as lending ceases due to solvency fears. The need for liquidity was a key change in the creation of the new standards, and it shone a spotlight on an asset that had largely been ignored for this purpose – physical gold.

Since the financial crisis government bonds have served to recapitalise the banks. As QE reduced interest rates the value of bonds increased.

If we have reached a point where interest rates increase, through distrust of government debt and bonds, this banking capital value will decrease.

Could banking flows into gold drive increased prices and become an essential counter-weight to decreasing bond values, and capital, for the banks?

http://bmg-group.com/gold-re-monetization-is-closer-than-many-realize/